YOUR AD HERE

Andrew Allemann Leave a Comment June 19, 2024

Company pitches a model that provides an incentive to place bids.

Picture this: you’re bidding in a domain auction. It goes on for hours, and you end up capitulating to some other domain investor. But you don’t walk away empty-handed.

That’s the idea behind GBM’s auction model.

The company’s auction technology incentivizes people to bid in auctions by giving them a bit of money for each bid they place. The incentive is calculated based on how much they outbid the previous bidder, with a higher percentage for bigger outbids.

For example, if the current bid is $100 and you bid $110, you might receive a $1 incentive when (if) you are outbid. If your bid increment is much higher, say $200, you might get a $20 incentive for your bid. (Marketplaces can customize the incentive structure.)

This incentivizes bidders to immediately bid up to the value they think the asset is worth; if they end up being outbid, they get a larger payout than if they bid in smaller increments.

I know what you’re thinking: isn’t there already a lot of shill bidding in domain auctions? Do I really want people in an auction who have no intention of winning?

It’s a fair argument. And certainly, this auction model will bring out many people who aren’t in it to win it.

But GBM’s model ensures that bidders actually pay, which could cut down on this a bit. It’s currently underpinned by smart contracts and blockchain technology. All bids are instantly funded from wallets and returned when someone is outbid. So when someone wins an auction, they have already paid and can’t walk away.

To date, GBM has focused on NFT auctions. However, it wants to partner with domain marketplaces to bring the technology to new audiences.

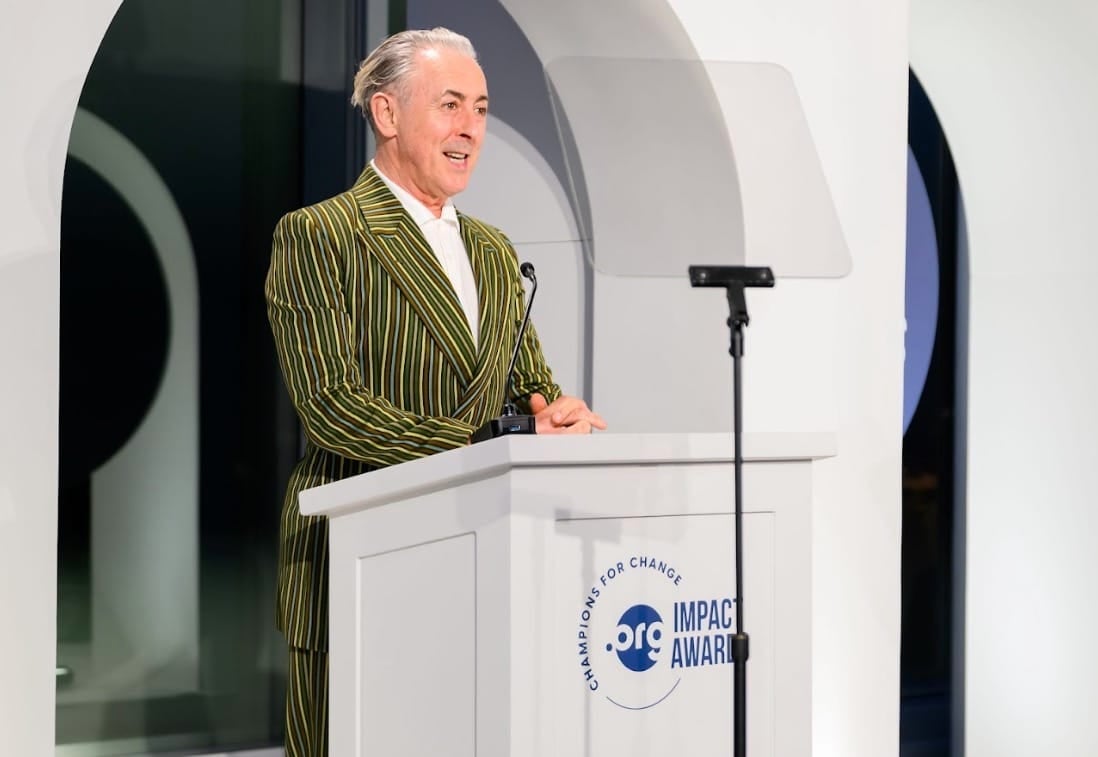

A big issue right now is the requirement to use crypto. Hugo McDonaugh, GBM co-founder and CEO, told Domain Name Wire that the next step is to enable fiat payments via pre-funded accounts. By making a deposit with a marketplace, all bids can be instantly funded to guarantee payment. In the future, GBM will try to work with payment providers who can handle real-time payments that don’t require deposits.

GBM has run over 70,000 auctions. It says its data show that final auction prices are typically 150% to 200% of what they would have been without the incentives.

That sounds great for sellers. Buyers might have a different opinion.

This video explains GBM’s model. I’m curious what readers think.

About Andrew Allemann

Andrew Allemann has been registering domains for over 25 years and publishing Domain Name Wire since 2005. He has been quoted about his expertise in domain names by The Wall Street Journal, New York Times, and NPR. Connect with Andrew: LinkedIn - Twitter/X - Facebook

Get Our Newsletter

Stay up-to-date with the latest analysis and news about the domain name industry by joining our mailing list.

No spam, unsubscribe anytime.

1 year ago

70

1 year ago

70

English (US) ·

English (US) ·