YOUR AD HERE

It’s time to reflect on 2024 at Afternic, with a look at the domain market dynamics. From top-performing TLDs to sell-through rates, and from average sales prices to revenue per domain, there’s plenty to unpack. Let’s dive into the charts and see what they reveal.

Top TLDs: .com Reigns, .ai Surges

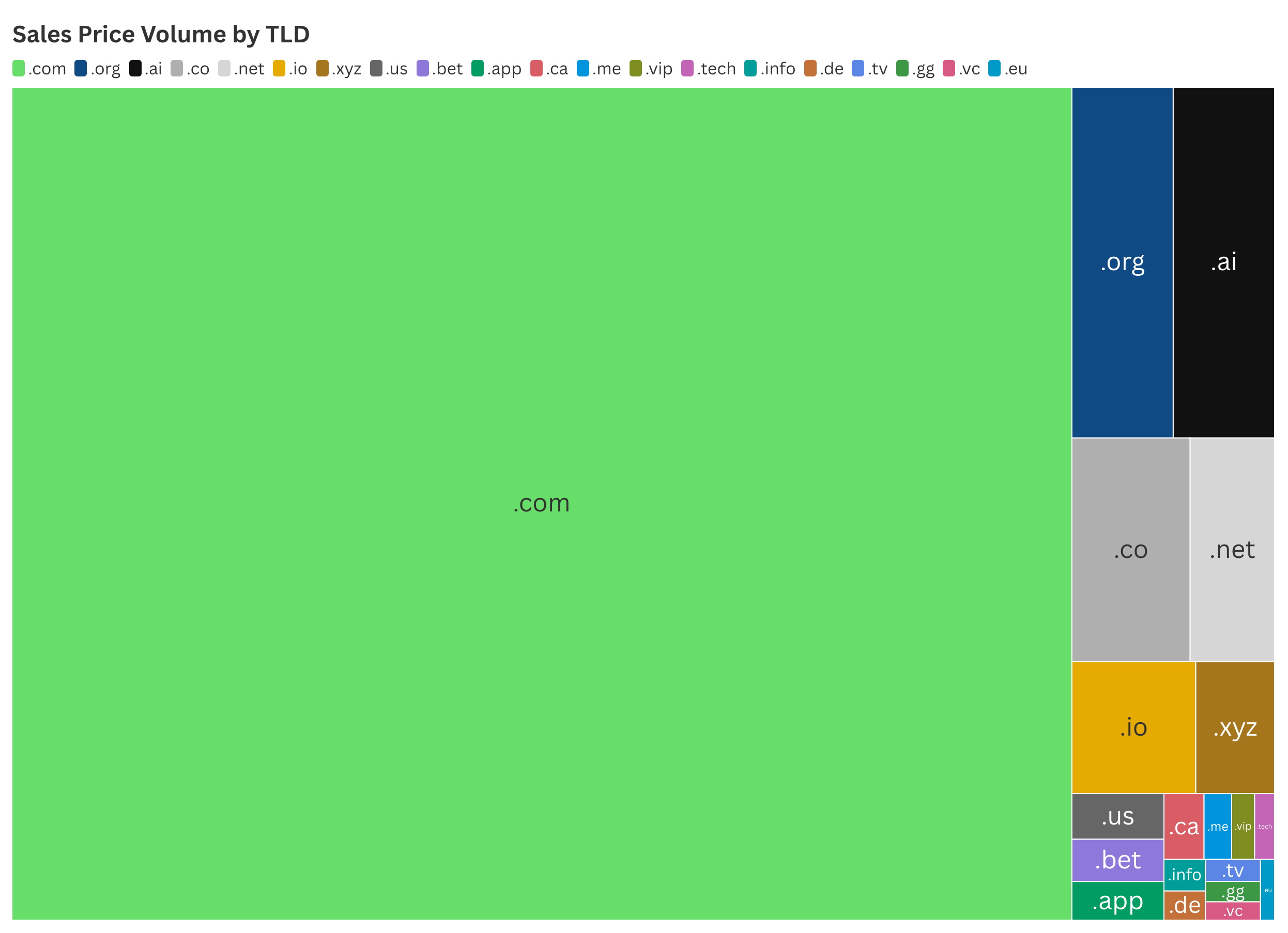

2024 TLDs at Afternic, ordered by sales price volume

The first chart highlights the sales price volume by TLD at Afternic in 2024. Unsurprisingly, .com continues to dominate the domain market, accounting for a significant portion of this chart. Its longstanding reputation and universal appeal make it a staple in any domain investor’s portfolio.

Coming in second, .org has maintained its solid performance, echoing its figures from 2022 and 2023. Its widespread use among organizations, nonprofits, and other areas underscores its enduring utility.

A highlight is the rise of .ai, which now sits in third place. Just two years ago, .ai wasn’t even in the top 20. By 2023, it had climbed to 10th, and now it has surged to third in this chart, ordered by sales price volume. This growth is a testament to the booming AI industry.

Rounding out the top ten are .co, .net, .io, .xyz, .us, .bet, .app and .ca, demonstrating the diversity and regional appeal of these extensions. The treemap, above, was created to best visualize the dominance of .com, and other TLDs.

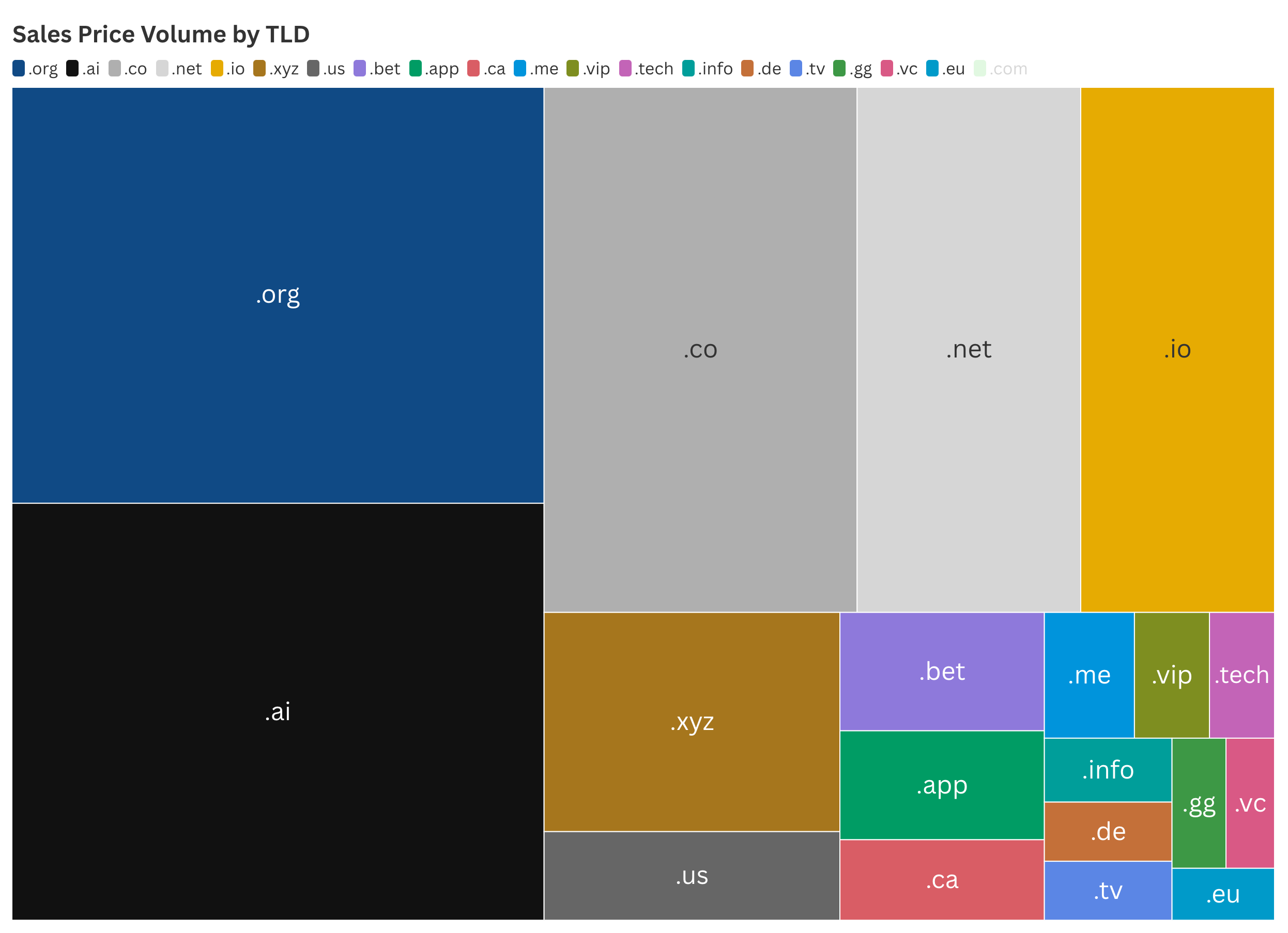

Without .com, you can get a better sense of the ranking of the other 19 TLDs.

2024 TLDs ordered by sales price volume, without .com

The complete top 20 includes:

- .com

- .org

- .ai

- .co

- .net

- .io

- .xyz

- .us

- .bet

- .app

- .ca

- .me

- .vip

- .tech

- .info

- .de

- .tv

- .gg

- .vc

- .eu

Sell-Through Rate: .ai Leads the Pack

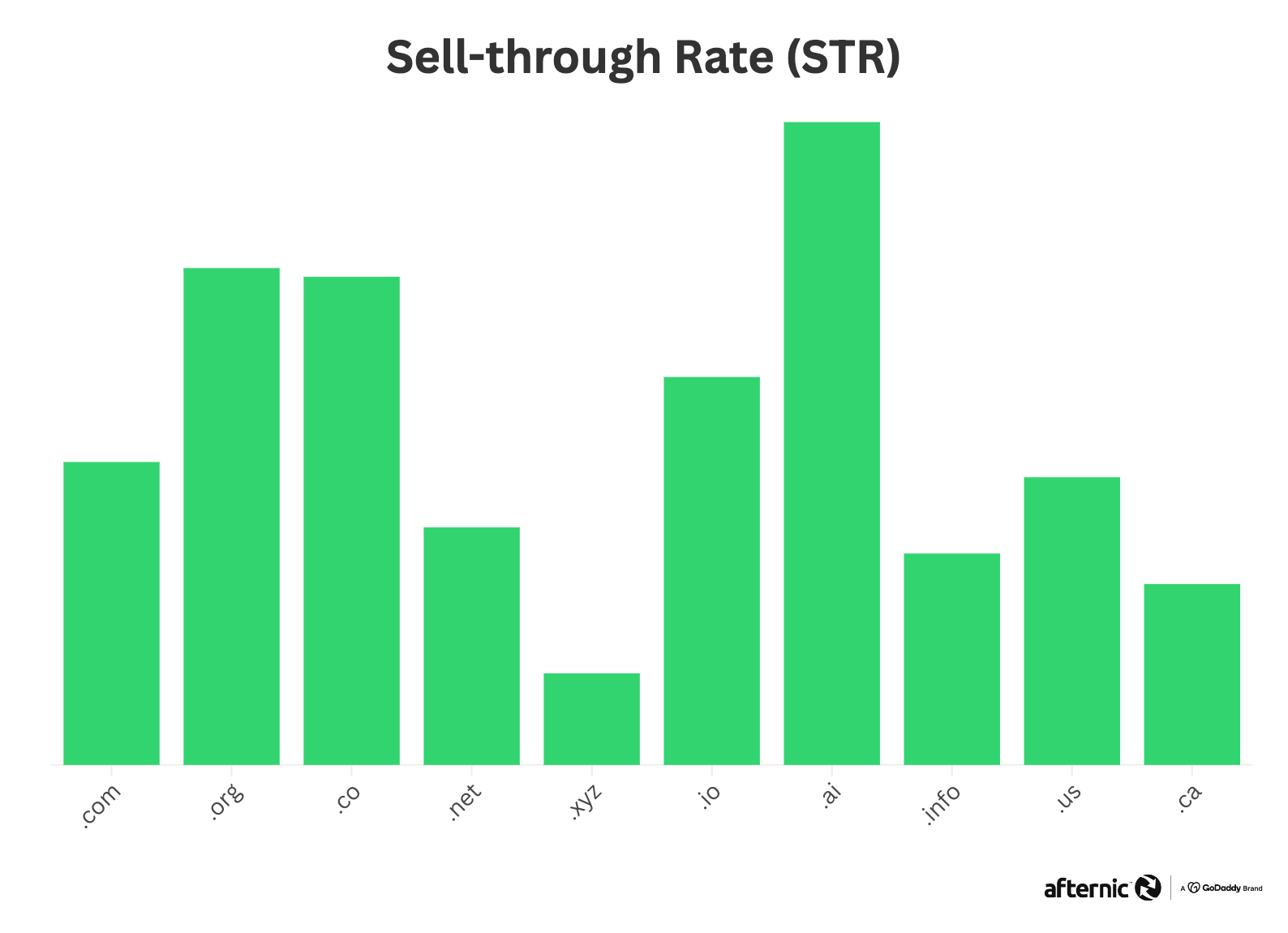

Sell-through rate, ordered by the number of units sold

The sell-through rate is a commonly used metric to understand the performance of a porfolio, or in this case, a TLD. It is calculated by dividing the number of domains sold by the total number of domains listed for sale.

According to the chart, which shows the top ten TLDs by unit volume (the number of domains sold), .ai boasts the highest sell-through rate, followed by .org and .co.

Last year, by contrast, saw .co leading the way with the highest STR, with .ai in second place. This reflects the robust demand for .ai domains, and their current popularity among new and existing brands in the tech space.

Average Sales Price: .ai Leads the Way

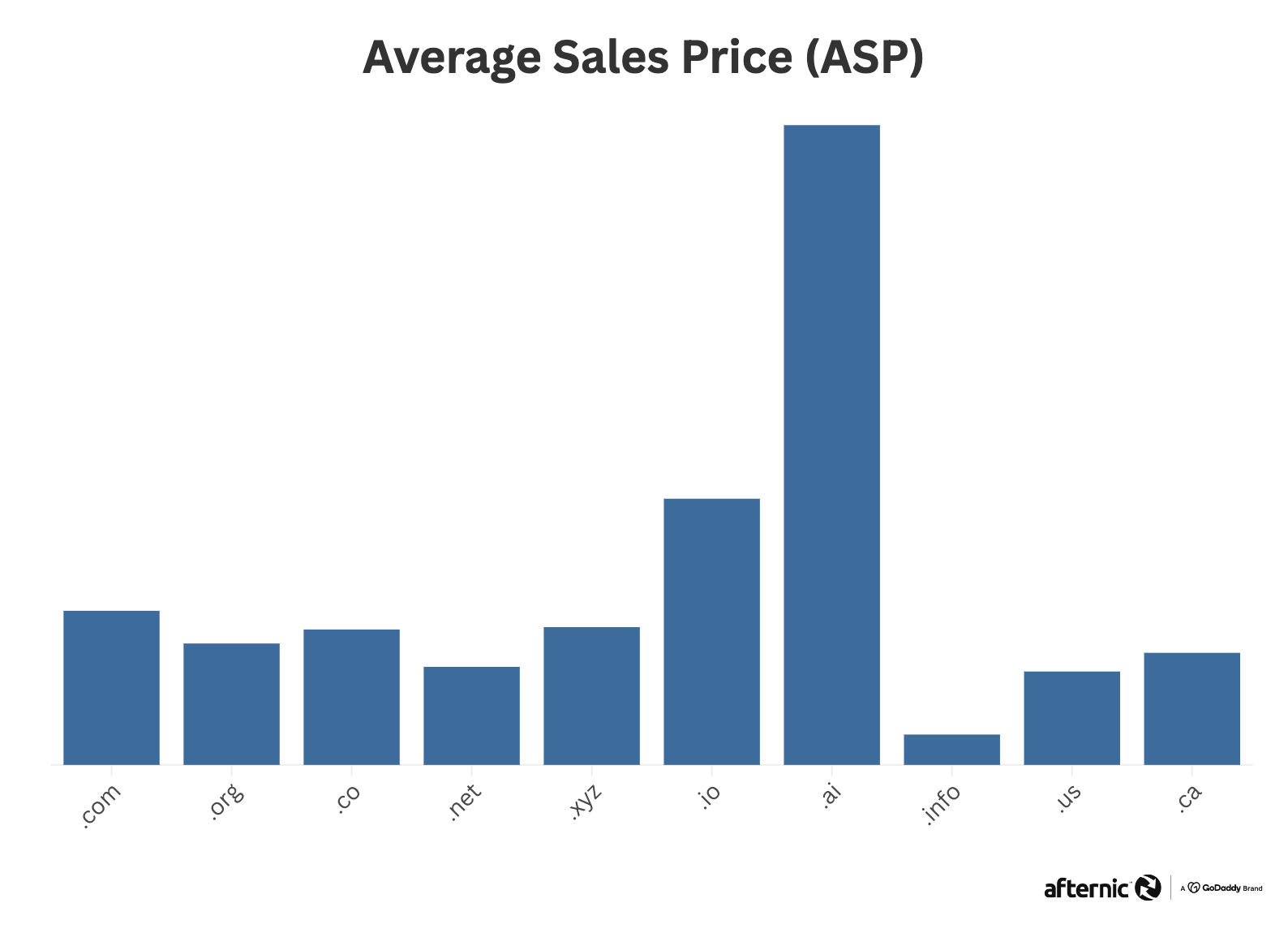

Average Sales Price, ordered by the number of units sold.

The average sales price, calculated by dividing the total sales revenue by the number of domains sold, provides insight into the market value of each TLD.

In 2024, .ai domains commanded a significantly higher average sales price, indicating their premium status and desirability in the market. Following .ai are .io and .com, both known for their broad appeal, with .io noted as one of the TLDs favored by tech brands.

2023’s stats also saw .ai leading the way, with .io in second place.

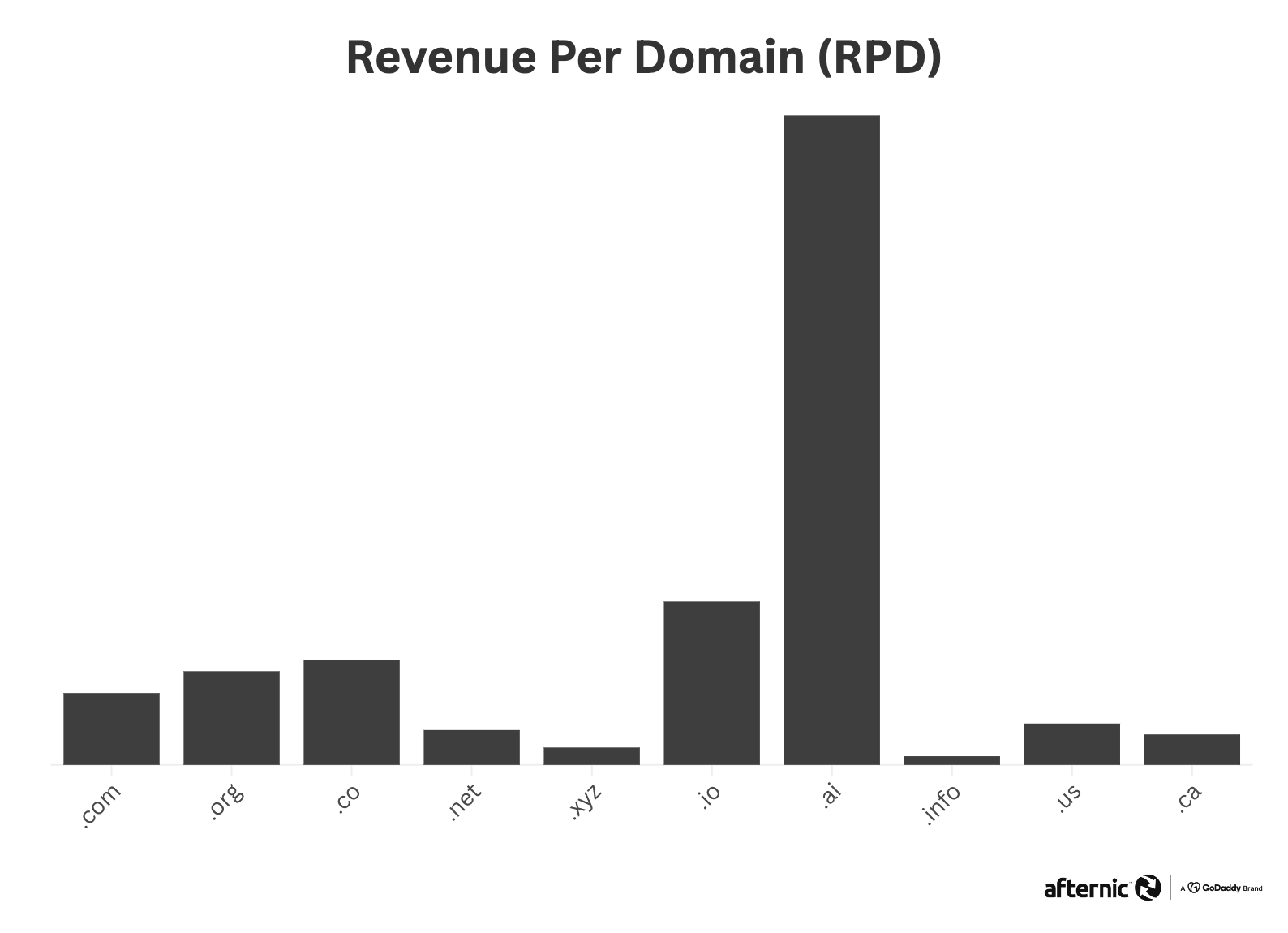

Revenue Per Domain: The Dominance of .ai

Revenue Per Domain, ordered by the number of units sold.

Revenue per domain, another vital metric, is calculated by dividing the total revenue generated by the number of domains sold. This figure helps investors understand the profitability of each TLD, and differs from average sales price (ASP), where ASP takes into consideration the number of domains sold, whereas revenue per domain factors in all domain names listed at Afternic.

Once again, .ai takes the lead by some way, indicating the potential profitability of .ai domain names at the moment. Behind .ai, .io continues its consistent placement, followed by .co, rounding out a top three of alternative popular TLDs.

Conclusion

The 2024 data from Afternic highlights the evolving landscape of domain investing, with .ai emerging as a formidable player alongside the stalwarts .com and .org. While .ai does lead the way in performance metrics, this reflects a selective pool of shorter, premium domains due to higher registration costs. These results should not be taken as an indicator of success for all .ai domains.

As we move forward, these insights can guide domain investors in making informed decisions and optimizing their portfolios for success.

2 days ago

1

2 days ago

1

English (US) ·

English (US) ·